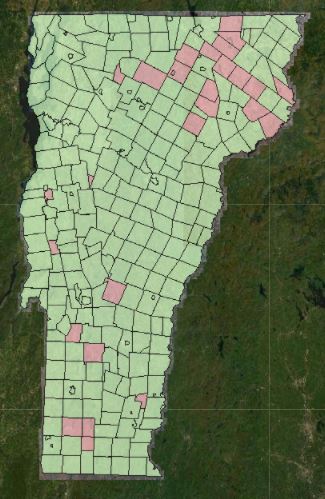

The National Flood Insurance Program (NFIP) provides a source of flood insurance for buildings in communities that choose to participate. Nearly ninety percent of communities in Vermont participate in the NFIP. Flood insurance is available for buildings and their contents anywhere in participating communities. Without access to the NFIP, flood insurance from private sources may be unavailable or prohibitively expensive. To participate in the NFIP a community must regulate all new development in high risk Special Flood Hazard Areas to ensure that new development is safe from flood damage.

Links to sections below:

For current map visit bit.ly/floodatlas

- What is the NFIP?

- Why Participate in the NFIP?

- How To Enroll in the NFIP

- Flood Insurance

- Administration of Hazard Area Regulations

What is the NFIP?

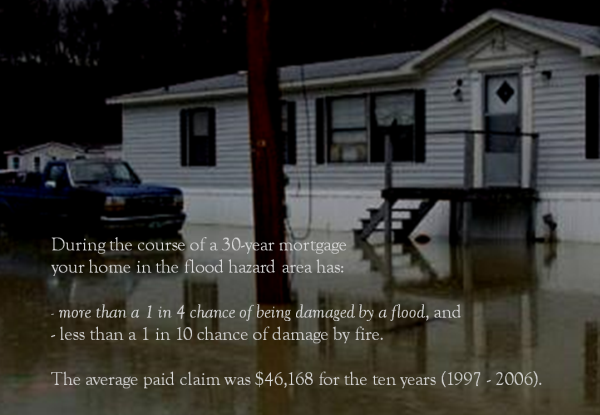

Two years after the massive floods of 1927 private flood insurance became largely unavailable. The NFIP was created by Congress in 1968 to provide a source of support to address continuing private flood losses. The NFIP is currently administered by the Federal Emergency Management Agency (FEMA). To participate in the NFIP communities must administer regulations to ensure that future development is safe from flooding. Following the losses due to Hurricane Agnes, in 1973 Congress required all federally-insured lending institutions to ensure that mortgages and other loans to structures in the Special Flood Hazard Area have adequate flood insurance. Lenders can set their own insurance requirements but under federal law the mortgage on a structure in the Special Flood Hazard Area must have coverage up to the value of the building, the amount available through the NFIP ($250,000 for a residence), or the amount of the mortgage – whichever is less.

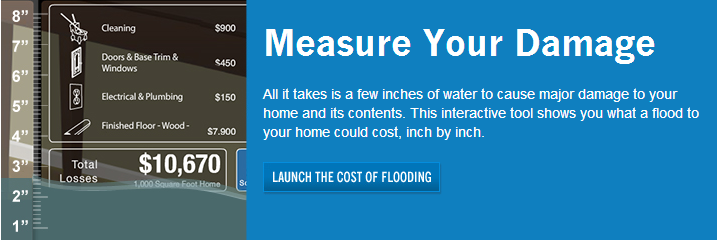

The cost of flood insurance is based on factors such as the replacement value of the building, the presence of a basement, the distance from water, the presence of a basement and the first floor height. Structures that are higher are safer and less costly to insure. Flood insurance for contents is an option. Flood insurance is available in all parts of the community including the low to moderate risk Zone X (or “Zone C”). Nearly 20% of flood insurance claims are for flood damage to buildings located outside the SFHA.

The National Flood Insurance Program was reconstructed in 2021 as Risk Rating 2.0. The calculation of the premium is now done based on a calculation using several factors. The detail available from an Elevation Certificate is no longer needed - but may be helpful.

Why Participate in the NFIP?

- Residents and building owners want access to flood insurance. Insurance is particularly important for structures and contents at a high risk of damage.

- If flood insurance is not available, then a potential buyer cannot secure a mortgage. The value of the property is limited to cash-only sales.

- Participation in the NFIP and having a Local Hazard Mitigation Plan allows the community to apply for FEMA Hazard Mitigation Grants to address community flood problems including elevating or removing buildings in dangerous locations.

- Participation in the NFIP is one of the basic mitigation steps that qualify communities for extra financial support after a disaster. See Post-Disaster Funding and ERAF.

How to Enroll in the NFIP

To participate in the National Flood Insurance Program the community needs to:

- Apply (a one page application form);

- Adopt a Resolution of Intent to participate;

- Adopt Flood Hazard Area Regulations that meet or exceed the requirements in 44 CFR 60.3;

- Complete an Enrollment Community Assistance Visit to ensure that the community has addressed any problems with recent development and is prepared to participate.

Communities seeking to participate in the NFIP should contact your DEC Regional Floodplain Manager and coordinate with the Regional Planning Commission. Here is more information about Joining the NFIP in Vermont.

Flood Insurance

Flood Insurance through the National Flood Insurance Program (NFIP) is available for buildings and/or contents anywhere in communities that participate in the NFIP. FEMA’s www.FloodSmart.gov provides information for consumers about flood insurance. Flood Insurance is required for mortgages and loans to buildings in the Special Flood Hazard Area.

In 2021 the National Flood Insurance Program was relaunched under Risk Rating 2.0. Here are several short videos to describe the determination of flood risk using Risk Rating 2.0. Quotes on flood insurance are available through your homeowners insurance policy carrier.

Basements are prohibited for new structures in areas at high risk of flooding. Older structures can be made safer and less expensive to insure. It is possible to fill in the basement below grade and elevate the lowest floor to make the structure safer and cheaper to insure. Talk to your insurance agent. Funding to support such mitigation may be available through the Hazard Mitigation Grant Program.

Myths and Facts About the National Flood Insurance Program

Administration of Hazard Area Regulations

Communities that participate in the National Flood Insurance Program (NFIP) are required to enforce municipal regulations so as to be sure that future development is safer from flood damage. Such regulations must meet or exceed the requirements to participate in the program (44 CFR 60.3) in a manner consistent with state law (24 VSA Chapter 117).

Model hazard area regulations are available through VT DEC. Please contact your DEC Floodplain Manager to select the best starting model for your community to work from.

The Vermont Planning and Information Center (VPIC) has information on the statutory process for Plan and Bylaw Adoption Tools. To participate in the NFIP communities regulate development in the Special Flood Hazard Area (typically shown as Zone A, AE, A 1- 30, or AO on a Flood Insurance Rate Map).

The municipality has an Administrative Officer (often the Zoning Administrator) to respond to inquiries from the public, review proposed development and to issue permits as appropriate. Under statute any complete application proposing new construction or substantial development in the Special Flood Hazard Area must be sent to the Agency of Natural Resources for comment in support of the municipal review process. The Administration of the bylaw must be consistent with the bylaw and state statute and meet or exceed the requirements in (44 CFR 60.3). A plain language version of NFIP requirements is available online as:

Floodplain Management Requirements: A Study Guide and Desk Reference for Local Officials FEMA 480 February, 2005 FEMA also provides this useful document in a printed or pdf format.

Municipal officials with questions about bylaws, administration, or review criteria are encouraged to contact the DEC Floodplain Manager for your community. Several Regional Planning Commissions have staff that are Certified Floodplain Managers and can help address administration questions. Certified Floodplain Managers (CFM) are certified through Association of State Floodplain Managers. If your community has many proposals for activity in the regulated hazard area these professionals are available as a resource to you. Contact VT DEC for more information on taking the CFM Exam.

FEMA also provides free training for officials on floodplain management at the Emergency Management Institute in Emmitsburg, Maryland. Look online for E273 Managing Floodplain Development thru the NFIP on their EMI schedule of training events. FEMA will cover tuition and most travel costs except for the cost of meals at EMI.

The role of the Administrative Officer is to do the work of the municipality as identified in the bylaw under statute. This includes helping individuals understand the Flood Insurance Rate Map and the municipal regulations, and to support the review of proposed development. After a flood disaster or other extensive damage to a building in a Special Flood Hazard Zone the AO will need to determine if there was Substantial Damage (as defined in the regulations) and help people understand their opportunities to document and respond to damage and prepare for repairs.

For more information on the hazard area regulation administration please see the VT DEC River Corridor and Floodplain Protection page, VPIC, and/or contact your Regional Planning Commission.

Back to Top